Last week, about a year and a half after the original launch of World Peace Foundation’s Compendium of Arms Trade Corruption, we published a new, revamped version of the Compendium (same address). We have added more by way of images, a resources page, a handy reference table of cases (increasingly necessary as the Compendium expands), and have redesigned the site. The biggest improvement since the launch, however, has taken place gradually as the Compendium has expanded from 18 to 36 cases, and older cases have been updated with new developments.

This article takes stock of some of the lessons to be learned from the material in the Compendium, and the work that’s gone into compiling it. Many of these are ones we already partially knew or suspected, but whose significance has been powerfully underlined. A longer analysis can be found in Sam Perlo-Freeman’s article in the Economics of Peace and Security Journal, Arms, corruption, and the state: understanding the role of arms trade corruption in power politics (paywall).

- There is a lot of corruption in the arms trade.

This hardly counts as a surprise, but the number of cases we have found – including many that are not yet in the Compendium – make clear just how deep-rooted corruption is in both international arms trade and in domestic arms procurement.

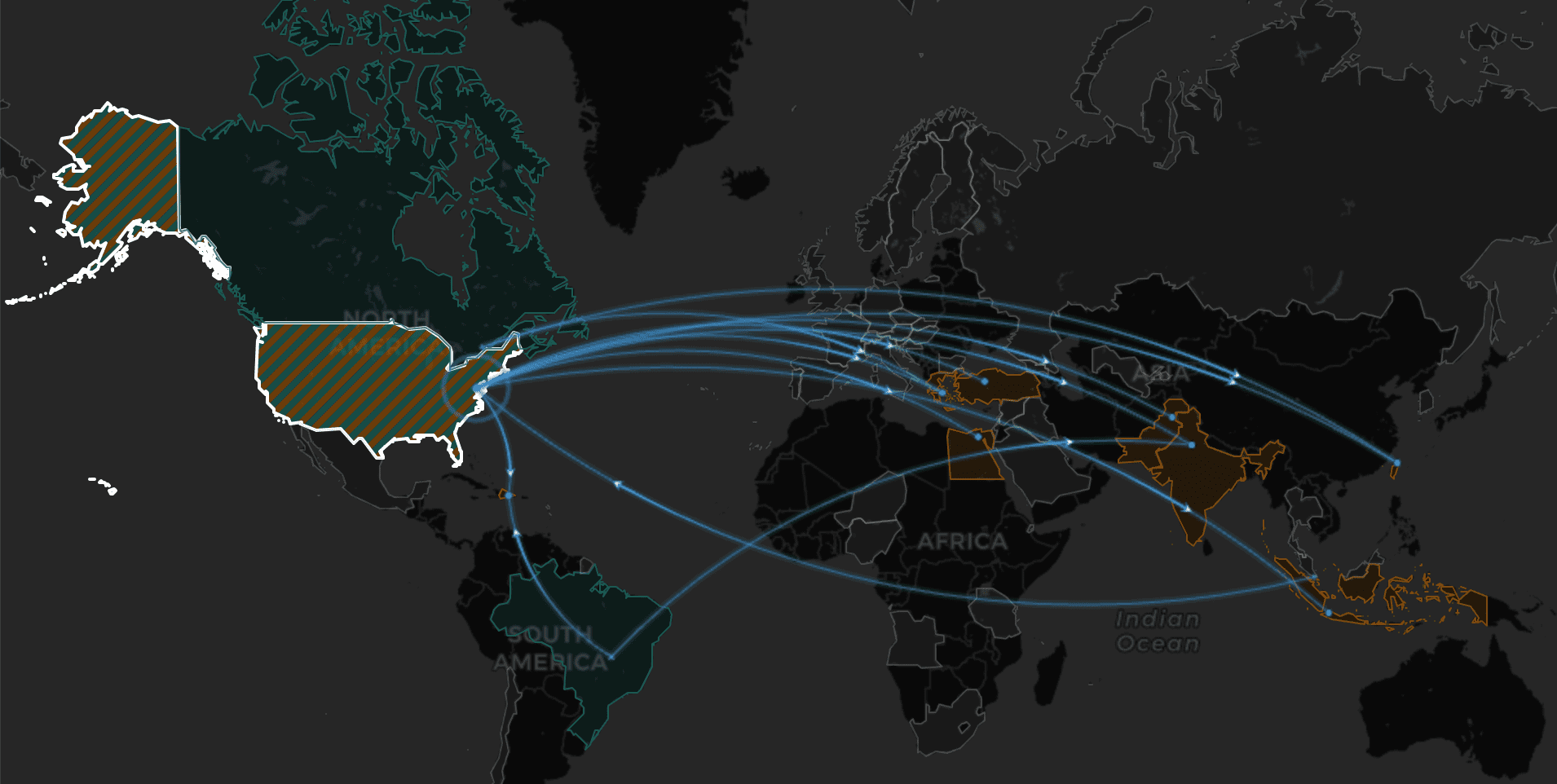

- The problem is global.

The ‘typical’ pattern we tended to have of arms trade corruption was of a ‘western’ company bribing a ‘third world’ country to secure a deal. But relative wealth, democracy, and reasonably strong institutions are no guarantee against corrupt arms deals. The Compendium includes cases where the buyers, and bribe recipients, are Austria, Belgium, Czechia, Greece, Israel, Portugal, and the USA. In the latter case, the ‘Fat Leonard’ scandal, it was a Malaysian company bribing US Navy officers to win contracts, the reverse of what is usually imagined as the ‘typical’ pattern.

- Institutions do matter.

Although bribery can crop up in arms procurement anywhere, the problem can be far worse in countries where military spending and decision-making lacks transparency, and monitoring and oversight institutions are weak. In such cases, corruption can go well beyond a 10% commission on the sales price being paid in bribes, and can encompass wholesale embezzlement – or ‘stealing’ as it’s more plainly called in Nigeria. In the Nigerian ‘Armsgate’ scandal, President Goodluck Jonathan gave his National Security Advisor Sambo Dasuki unchecked control over the country’s military procurement budget, including both on- and off-budget spending, with no oversight. Dasuki proceeded to loot at least $2 billion in state funds during his 3-year tenure, enriching himself and his cronies—encompassing a wide swathe of Nigerian politicians, military officers, businessmen, and officials—using fake procurement contracts for which no equipment was ever delivered.

- In some sectors, corruption seems to be almost ubiquitous.

Especially submarines, and European sales of major combat aircraft.

Submarines are hugely expensive, and not many countries actually need them. They are perfect bribe vehicles. European companies selling major combat aircraft are competing in a crowded market dominated by the US and Russia. Bribery is one of their main competitive advantages compared to the US.

- US companies really do seem to bribe less.

Not because they are inherently cleaner or more moral. But the US Foreign Corrupt Practices Act (FCPA), banning bribing of foreign officials, has been in place a lot longer than comparable legislation in Europe, is more robust, and is subject to more rigorous enforcement. The biggest cases of arms trade corruption prosecuted by the US authorities in recent years have been of companies like BAE Systems and Embraer, whose main bases are in the UK and Brazil respectively. Cases involving US-headquartered companies, like Litton Industries, are much smaller beer.

But this more rigorous enforcement may have a lot to do with the fact that US companies have far less need to bribe: the US generally has the most technologically advanced equipment, and US arms are often in high demand due to the security guarantees that come with them, that no other country is able to offer to a comparable level.

Moreover, US companies have the largest domestic market in the world in Department of Defense (DOD) procurement, and are thus much less dependent on exports than their European counterparts. The US domestic arms market is one in which influence peddling in the form of unlimited campaign contributions, lobbying, and a 2-way revolving door, is entirely legal, and where lawmakers frequently add money to the DOD’s budget request to generate extra spending in their districts, so there is little incentive to take the risks that come with illegal forms of corruption. (This didn’t stop Boeing and Darleen Druyun in the Boeing Tanker case, where Druyun, a senior DOD procurement official, negotiated a job for herself with Boeing while also negotiating a contract with them. Her tragedy is that she almost certainly wouldn’t have needed to cross the legal line to obtain the desired outcome).

- It’s really hard to get convictions for arms trade corruption

The Compendium is littered with cases where, despite the fact that it is clear that illicit payments have taken place, suspected bribers and bribe recipients have either not been charged, or have been acquitted in the original trial or on appeal, or where only low-to-mid level officials have carried the can for corruption that must surely have extended higher up to have been able to swing deals.

There are both political and practical reasons for this. High level politicians and government and company officials often enjoy political protection, and can maintain plausible deniability for actions carried out by subordinates. (This is far from unique to arms trade issues). Authorities in exporter countries are frequently loathe to prosecute major arms companies, which wield considerable political influence themselves, and which are seen by national governments as an essential strategic asset. The most glaring example of this is UK Prime Minister Tony Blair’s 2006 decision to cancel a corruption investigation into the Al Yamamah arms sales to Saudi Arabia, to protect British arms giant BAE Systems and clear the way for further Saudi contracts. But even in other cases where action has been taken against arms companies, penalties are typically light, and restricted to corporate fines as part of Deferred Prosecution Agreements, while senior company officials are virtually never held accountable.

But at a practical level, proving corruption in major international deals, arms or otherwise, is genuinely hard; the deals typically involve a complex web of intermediaries and shell companies, making the trail of payments hard to trace. It may be possible to prove that a company made an illicit payment, or that a certain key agent received a large sum of money that appears connected to a deal, but not who was the ultimate beneficiary of the payments, or to prove that there was a quid pro quo concerning a particular deal.

- Bribes are often about political finance as much as personal enrichment.

Certainly, personal greed is one motivation for political leaders and officials to seek bribes in connection with arms deals. But in a high proportion of cases we have studied, some or all of the corrupt payments have been used to fund political parties and/or election campaigns. Politics is expensive, and especially where there are strict rules on campaign funding and political donations, or where legitimate sources of political funding are simply scarce, politicians often want an additional off-the-books source of funding for elections (national and intra-party), for regular party activities, and for building and maintaining a political patronage network.

Arms deals, being highly political affairs by their nature, in which senior politicians are often directly involved, and which are often subject to a greater degree of secrecy than other transactions, often provide an ideal vehicle for such a purpose.

This aspect of arms trade corruption is discussed in depth in the World Peace Foundation occasional paper, Arms trade corruption and political finance.

- For exporting countries, arms trade corruption is industrial policy.

With the exception of the United States, and perhaps now China, most major arms producers are attempting to sustain an advanced arms industry based on limited domestic demand. Major new systems, such as combat aircraft, submarines, frigates, and other big-ticket items, are produced maybe once every 30 years, with limited national production runs. Exports are needed to keep production lines open, and technological capabilities functional, but demand in the international market is likewise limited, and multiple arms producers are competing for this tight market: the US (which dominates the market), Russia, the UK, France, Germany, Sweden, Italy, and China having a stake in most of these areas. Corruption, whether to gain a competitive advantage or even to create demand in the first place, is therefore an essential competitive tools for some of these companies. National governments in turn are inclined to turn a blind eye to such corruption, or at least treat the companies concerned – their ‘national champions’ – with kid gloves.

The underlying assumption here, which is barely questioned in mainstream security and defense circles, is that maintaining an advanced domestic arms industry is an unquestioned good, and essential to national security and influence. In all too many cases, this goal has therefore been placed above anti-corruption objectives.

What next?

World Peace Foundation’s work on global arms and corruption is continuing, and we intend to continue to expand and update the Compendium, and in particular to start developing more analysis of its content and what it shows about the phenomenon of arms trade corruption worldwide. One of the principle outputs of this work so far is the report on Arms Trade Corruption and Political Finance referred to above, which came from the observation that political finance was a factor in so many of the cases in the Compendium. Some of the ideas for further work we have include:

- Red flags: What are the ‘red flags’ for arms deals that might give rise to the suspicion that corruption could be involved, and that closer investigation would be appropriate? Transparency International Defence & Security have already done some work on this in terms of recipient countries, and their potential susceptibility to defense corruption, through their Government Defence Anti-Corruption Index. Other signs one could look for include: purchases that don’t appear to meet a clear security need; acquisitions beyond a country’s ability to maintain and operate the systems acquired; hasty and ad-hoc acquisitions; late changes to requirements, and increases in price; top-level political involvement in decision-making. Other red flags may be of a more technical nature in terms of the financial flows and the modalities of contract negotiations.

- Offsets: At least 10 of the cases in the Compendium involve offsets as a significant factor. Offsets – where the seller company agrees to make investments in the buyer country, to carry out some of the work on the deal in the buyer country, to partner or subcontract with local industry, and/or to make other counter-purchases from the buyer country, are almost ubiquitous in international arms deals, and are widely recognized as a major corruption risk. Typically involving even less transparency than the main arms deal, they offer large potential benefits to companies in the buyer country that are recipients of offset contracts. Those involved in the procurement process are often able to steer offset investments and contracts to companies that benefit themselves, friends and family, or political allies. Moreover, the indirect nature of these benefits may create an effective layer of plausible deniability that makes it much harder to prove that a seller company, or a decision-maker, has acted corruptly. However, these very factors make the phenomenon of offset corruption one that is very difficult to get a handle on, and successful prosecutions for this are rare. There is therefore considerable scope for trying to increase our understanding of the ways in which offset corruption works, its significance, and how it impacts the international arms trade.

- More country studies: We have carried out country studies of Indonesia and Russia, but there is plenty of scope for more.

- More deals: Speaking of red flags, there are a number of deals in the news that raise plenty, and that we wouldn’t be surprised to see getting entries in the Compendium in the future – although at present there is little or no direct evidence of corruption:

- India’s Rafale deal – India agreed to buy 36 Rafale combat aircraft from France in 2016, having cancelled a previous deal for 108. The opposition Congress Party have been crying foul for a number of reasons: the high price per plane being one, but most notably the choice of local partner for production of some of the planes in India (see above under offsets). The Rafale’s producer, Dassault, has partnered with Reliant Aerospace Ltd., a recently-formed subsidiary of the Reliant corporate empire, owned by the politically well-connected billionaire Anal Ambani. Reliant has no experience in aerospace, and the natural local partner would arguably be state-owned Hindustan Aeronautics Limited (HAL), who have been manufacturing foreign-designed planes under license for decades. The government of Prime Minister Narendra Modi claimed the choice of local partner was Dassault’s; but Dassault and the French government have made clear that the choice of Reliant was required by the Indian side. Was the deal steered to Reliant in return for some sort of political favor from the highly influential Ambani?

- Qatar’s hybrid air force – tiny Gulf state Qatar, after years of fairly limited major arms purchases, is to increase the size of its air force eightfold, with the acquisition of 96 advanced combat aircraft from three different countries: the US’s F-15, France’s Rafale, and the Eurofighter Typhoon from the UK. While some commentators have suggested that the slightly different capabilities of the three aircraft are a possible explanation, basically this makes no sense. Three different aircraft means needing three different maintenance and repair contracts, three separate supplies of spare parts and upgrades, three training programs, and three different systems that need to be able to communicate with each other operationally. Moreover, Qatar has far too small a manpower in its air force to be able to operate so many planes, and is likely to have to employ expatriate workers, including even mercenaries, to fly and operate them. The final deal, for the Eurofighters, was also negotiated extremely hastily in 2017. Moreover, Qatar provides absolutely zero transparency regarding its military spending and arms procurement – not even a single total spending figure. Qatar is accordingly rated in Band ‘F’ of Transparency International’s government anti-corruption index, indicating the highest possible corruption risk. Their report for Qatar notes “Qatar has no defined process for acquisition planning – the process through which the state identifies what arms it will buy –all Qatari military procurement is exempted from public tender and most contracts are single-sourced. Our assessment described purchase decisions as, at times, “seemingly bizarre”. This is not to say that any or all of these deals are corrupt, and at present there is no evidence of this. However, the number of red flags raised suggest that deeper scrutiny would be advisable.

In conclusion, the work we have done on the Compendium has both confirmed our expectations as to the prevalence of arms trade corruption, and sometimes provided new insights regarding the forms it takes and how deeply and systematically corruption is embedded into the political and economic structures of militarism.